Topics

Finance & Revenue

Finance & Revenue

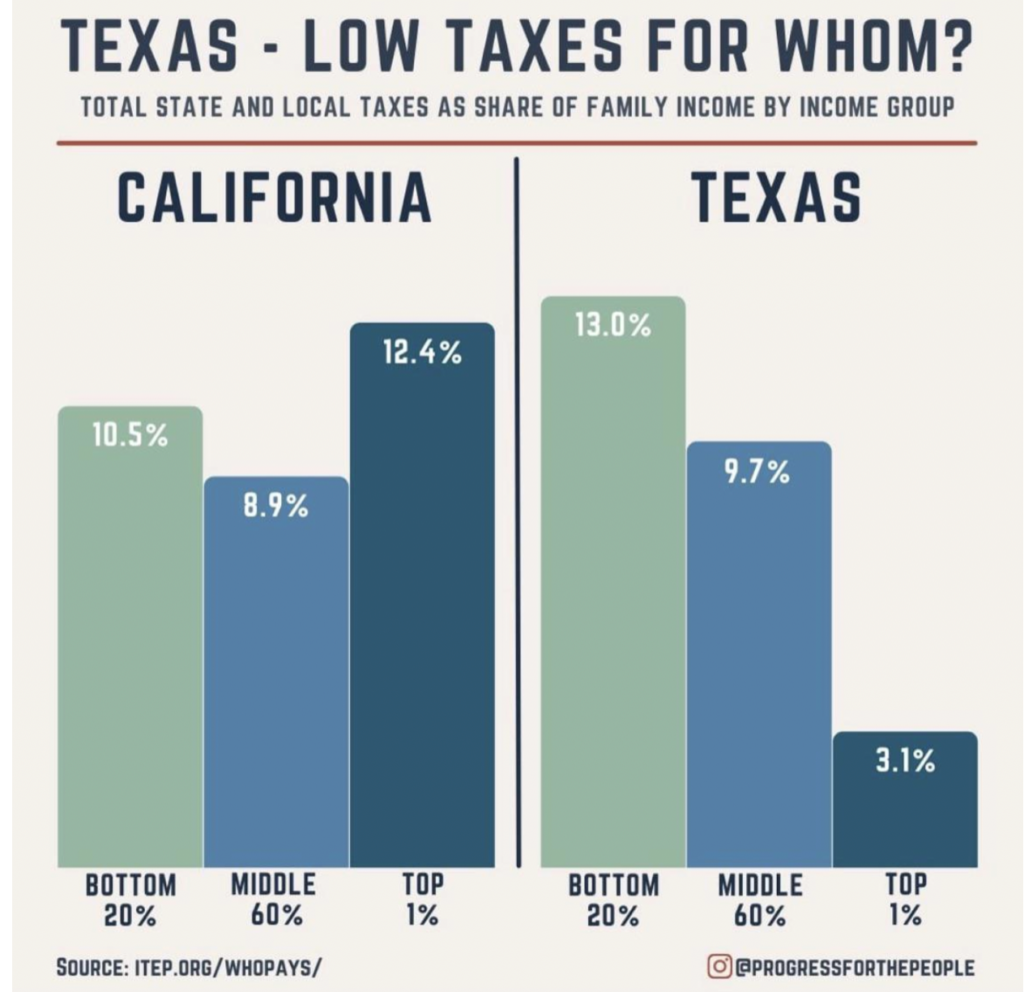

Who pays more taxes? Texans? Californians?

What is happening? A graphic based on 2018 tax revenue data of the Institute of Taxation and Economic Policy is said to show that more Texans pay more taxes than Californians.

Why is this important? The supporters that say Texans pay more in taxes say that the bottom 20% pay 13% of tax revenue, the middle 60% of Texans, pay 9.7%, and the top 1% of texans pay 3.1%. In contrast, in California the bottom 20% pay 10.5%, thee middle 605 of Californians pay 9.7% and the top 1% of California’s pay 3.1%

How will this be important? A University of Texas at Austin School of Law Professor says that states with income taxes do more to lower inequality than Texas, which has no income tax.

Reform Austin | Most Texans Pay More In Taxes Than Californians

Thank you for subscribing to our newsletter.

Great things are just around the corner!